- Most questions contain a brief summary of the issue at hand. Chief Information Officer GCIO Complaints Feedback.

They stay together in Malaysia as Mr Lee is managing a partnership business with his friend Double Hero Enterprise in Malaysia.

. Only ONE language is to be used. Exam 10 August 2012 questions and answers. All workings MUST be shown as marks will be awarded.

Accounting questions and answers QUESTION 2 10 MARKS. PTPTN Loan Repayment PTPTN LOAN REPAYMENT. Self assessment system is an approach whereby taxpayers are required to determine.

Hours 15 minutes this question paper is divided into two sections. The QAs range from the basics of GST regisration to discussions on the Director-Generals interpretations of the law and includes interesting scenarios to enable readers to go beyond the answers to grasp the concepts raised and apply them to real-life work situations. 1314 Income tax shall be charged for each year of assessment upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia.

MALAYSIAN INCOME TAX LAWANSWERS TO TUTORIAL QUESTIONS 2015 Week 2 - Q1 - 5 Question 1 a i Scope of charge sec 3 - Lays out the tax net for Malaysia- p. Question and Answer of Finance and Taxation. Ans- Income which has been earned but not yet received is known as accrued income.

1st april 1971 c. When the Capital Asset is being sold or transferred the profit or gains arising out of it or you can term that as the difference between the actual price at which the asset was acquired and the. Vietnam VNM Zimbabwe ZWE To view PDFs of past exam papers for Malaysia please select from the list below.

Malaysia Budget 2021 Expectations. Download the piece by our subject matter experts. Dania a Malaysian resident is married with 3 children.

Income tax is collected on all types of income except. There are only two history of Malaysia Taxation are Income Tax Ordinance 1947 and Sarawak Inland Revenue Ordinance 1960. Section ll 15 questions.

The Income Tax Act came into force from. During reading and planning time only the question paper may be annotated. Tax rates and allowances are on pages 24.

The company prepares its accounts to June 30 annually. Tax computation for the year of assessment 2016 Note Add Ded - Business income RM000 RM000 RM000 Profit before taxation 16010 Cost of sales 3 Less. Dividends-single tier local 1 18 Dividend foreign.

The interest expense is a revenue cost and thus does not impact on. This question paper must not be removed from the examination hall. Answer choices True False Question 2 30 seconds Q.

Question and Answer of Finance and Taxation. Questions and answers by Deloitte Malaysia Tax Partners. Taxation malaysia 2018 sample questions f6 mys acca time allowed.

User Manual User Manual About Us About Us. Tax Corp Chapter 3. Income is recorded in the same accounting period in which it is earned rather than in the subsequent period in which it will be received.

You must NOT write in your answer booklet until instructed by the supervisor. ADVANCED TAXATION Answer ALL questions Question 1 Kitchen Ware Sdn Bhd has been in the business of manufacturing kitchen utensils for both the local and export markets since 1999. This paper consists of FIVE questions.

National Recovery Plan NCR. Exam 11 May 2018 questions and answers. Two children are twins 13 years old and the last is 6 years old.

ISA 706 Revised - AAAA. Income Tax Questions And Answers Q11Which income is considered as accrued income. 2 ACCESS PAGE Calendar.

15 Questions Show answers Question 1 30 seconds Q. In Malaysia each source of income is distinguished for the purpose of determining the statutory income from that source. 1st march 1971 b.

Each answer should begin on a separate answer booklet. Capital gains means the profit earned from the sale of an asset. 30 MINUTES Mr Lee is a Malaysian citizen and he got married to his wife an Australian.

TAXATION IN MALAYSIA 2020 ANSWER ALL QUESTIONS Explain the theory of Double dividend of taxation. If Creek is a closely held C corporation that is not a personal service corporation PSC it can deduct 230000 of the passive activity loss in the year. The Income Tax Act 1967 as amended is referred to as ITA.

Answers 2 C Disposal consideration 2000 Acquisition cost 500 Stamp duty 6 506000 Chargeable gain 1494 Tutorial note. Taxation Paper F6 MYS. MALAYSIAN TAXATION Question 1 USE TAX RELIEF 2018 If it requires PLEASE TRY TO DO IT QUICKLY Show transcribed image text Expert Answer Transcribed image text.

She is a bank manager HSBC. SET 1 ANSWER FOR EXAM SEPTEMBER 2016 MIAQE TAXATION ANSWER 1 Merci Engineering Sdn. You may answer this paper EITHER in English OR in Bahasa Malaysia.

Bahasa Melayu BM Register Login. Creek Corporation had 210000 of active income 45000 of portfolio income and a 230000 passive activity loss during the year. Business Taxation Multiple Choice Questions INCOME TAX ACT 1961 1.

8 marks Provide the tax privileges a resident company enjoys as compared to their non resident counterpart. 8 marks Provide the exception to the rules of determining the scope of the charge to the Malaysian Income Tax. Answer choices their taxable income.

Do NOT open this paper until instructed by the supervisor. To practice TX MYS exams in the CBE environment you can access the June September and December 2019 sample questions and answers Download past exam papers Questions PDF March 2020 questions PDF Sample SeptemberDecember 2018 questions. In other words expenses incurred in earning the gross income from one source can only be deducted from that income and not against income from any other source referred as general rule.

Deloitte Malaysias Panel of Tax Partners share their insights and analysis ahead of Budget 2021 announcement through a series of questions and answers.

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

What Is Difference Between Nri And Nre Accounts In India

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

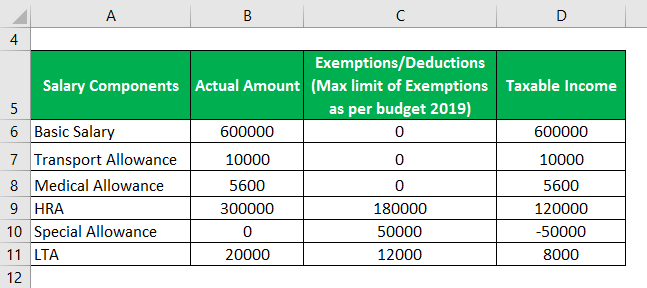

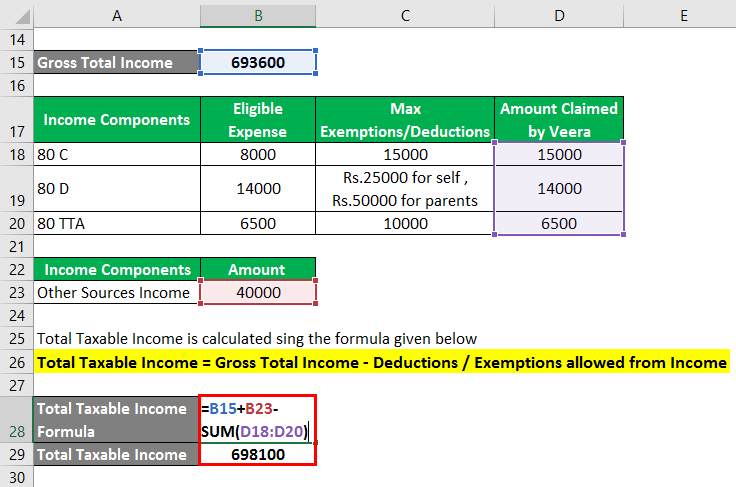

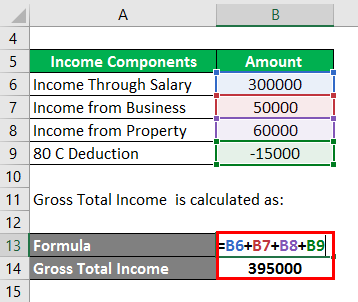

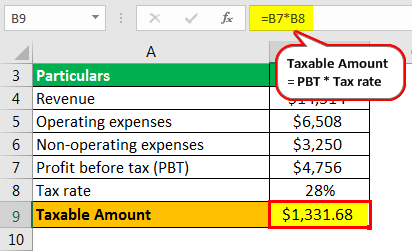

Taxable Income Formula Calculator Examples With Excel Template

Provision For Income Tax Definition Formula Calculation Examples

Taxable Income Formula Calculator Examples With Excel Template

Malaysian Tax Issues For Expats Activpayroll

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Taxable Income Formula Calculator Examples With Excel Template

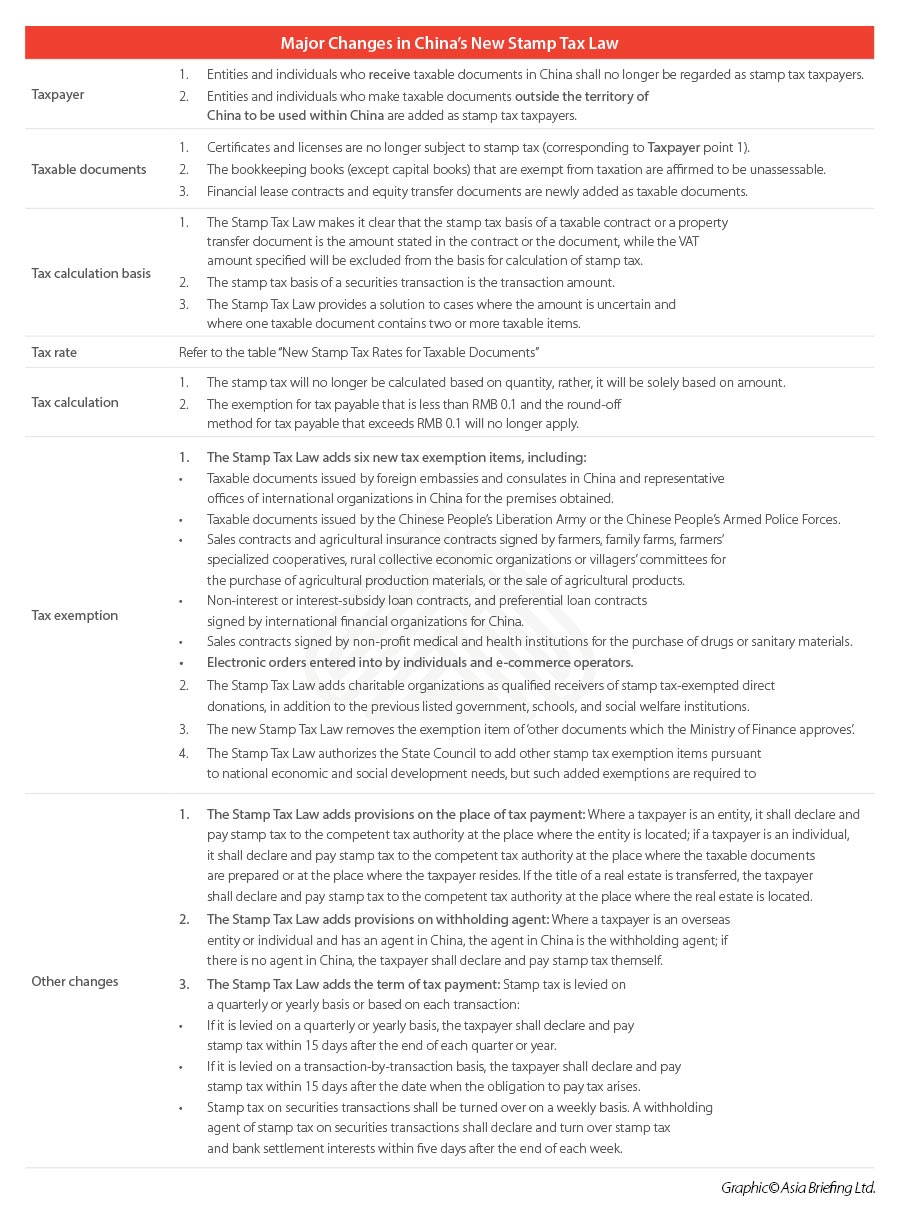

China S New Stamp Tax Law Compliance Rules Tax Rates Exemptions

Taxable Income Formula Calculator Examples With Excel Template

Provision For Income Tax Definition Formula Calculation Examples

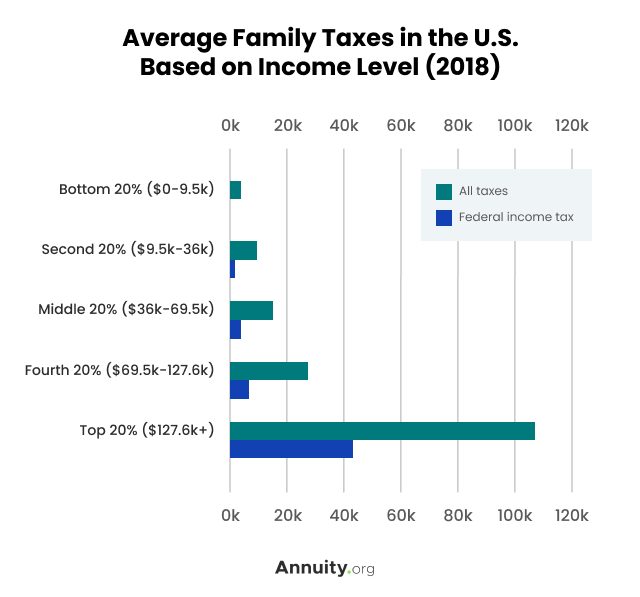

Tax Information What Are Taxes How Are They Used

Introduction To Income Tax Computation Acca Taxation Tx Uk Exam Fa2019 Youtube

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)