Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited DTTL its global network of member firms. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied.

Equity Of Health Financing In Indonesia A 5 Year Financing Incidence Analysis 2015 2019 The Lancet Regional Health Western Pacific

Previous position in PR 12014 Revised position in PR 112018 Regrossing of payment made to non-resident in.

. 22 If the non-resident has a PE or a business presence in Malaysia payment received constitutes a business income which is derived from Malaysia and will be taxed under paragraph 4a of the Act. A Ruling may be withdrawn either wholly or in part by. B deduction of tax from special classes of income.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. 112018 Translation from the Study Resources. And c consequences of not deducting and remitting the tax from special classes of income.

The Ruling updates and replaces PR No. Income tax is chargeable on the following classes of income. Highlights of the changes made in the PR 1.

The Inland Revenue Board of Malaysia IRBM has issued Public Ruling PR No. B gains or profits from an employment. Relevant Provisions of The Law.

The PR replaces the old PR No. F gains or profits not falling under. C dividends interest or discounts.

See Terms of Use for more information. D rents royalties or premium. E pensions annuities or other periodical payments not falling under any of the foregoing classes.

The Director General may withdraw this Public Ruling either wholly or in part by. The objective of this Public Ruling PR is to explain - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA. 12014 of 23 January 2014.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. The Ruling updates and replaces PR No. The highlights of the changes are as below.

The withholding tax on payments made to non-residents which fall within the Special Classes of Income category the Malaysian payer is not required to regross the payment amount to compute the withholding tax due and payable to the IRB. Paragraph 143 is amended as follows amendment shown in green text Where the withholding tax is not due for payment and no payment or crediting is made to the non-resident payee. 30 The main criteria that determine whether withholding tax under section 109 or 109B of the Act applies are as follows -.

112018 of 5 December 2018. 112018 which explains the special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA and related withholding rules. View PR_2018_11 Withholding Tax On Special Classes Of Incomepdf from AA 1INLAND REVENUE BOARD OF MALAYSIA WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME PUBLIC RULING NO.

A gains or profits from a business. 102019 which explains the special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA and the related withholding rules. It sets out the interpretation of the Director General in respect of the particular tax law and the policy as well as the procedure applicable to it.

The Inland Revenue Board of Malaysia has published Public Ruling No.

Pdf Earnings Management In Malaysian Public Listed Family Firms

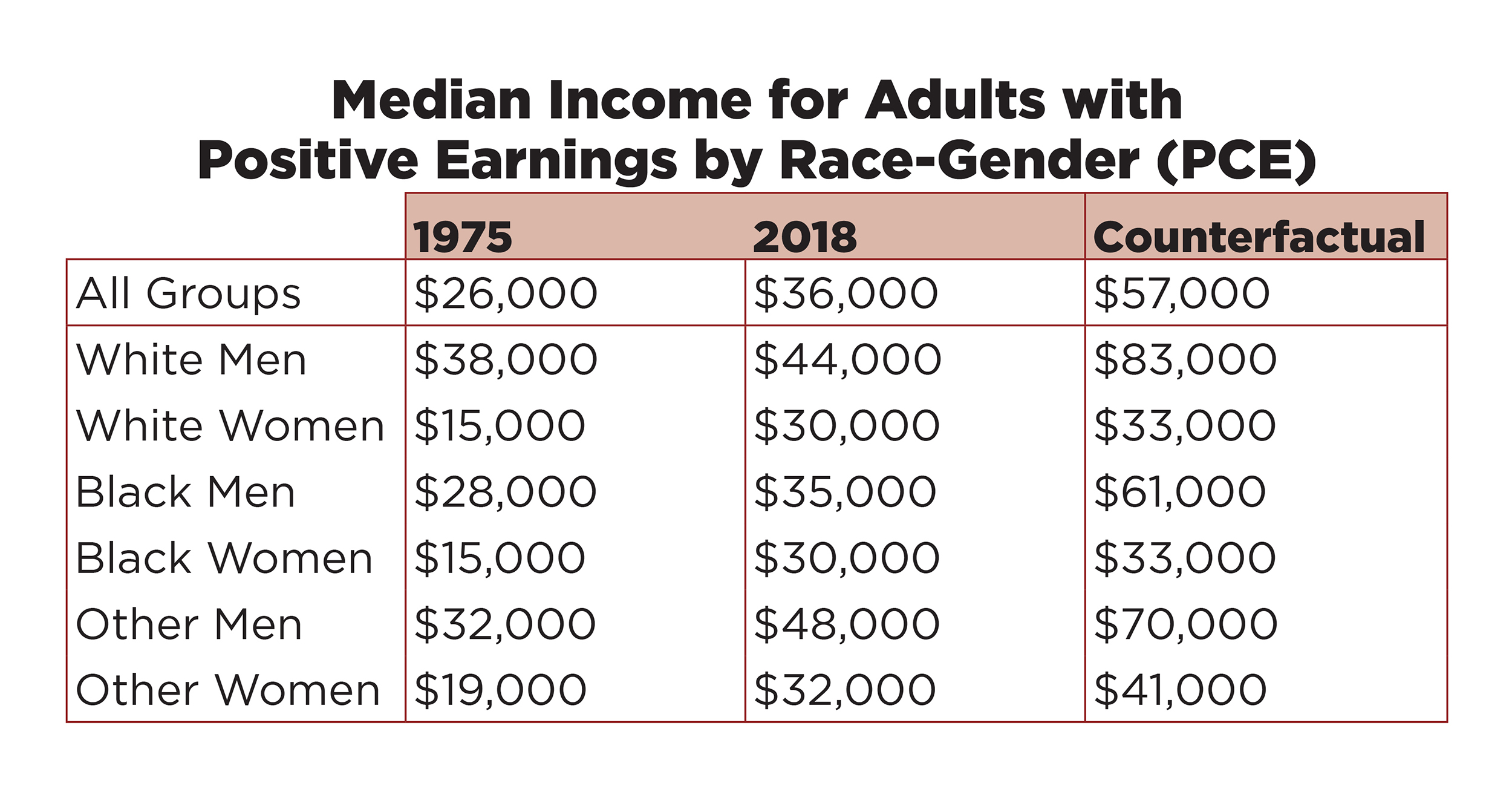

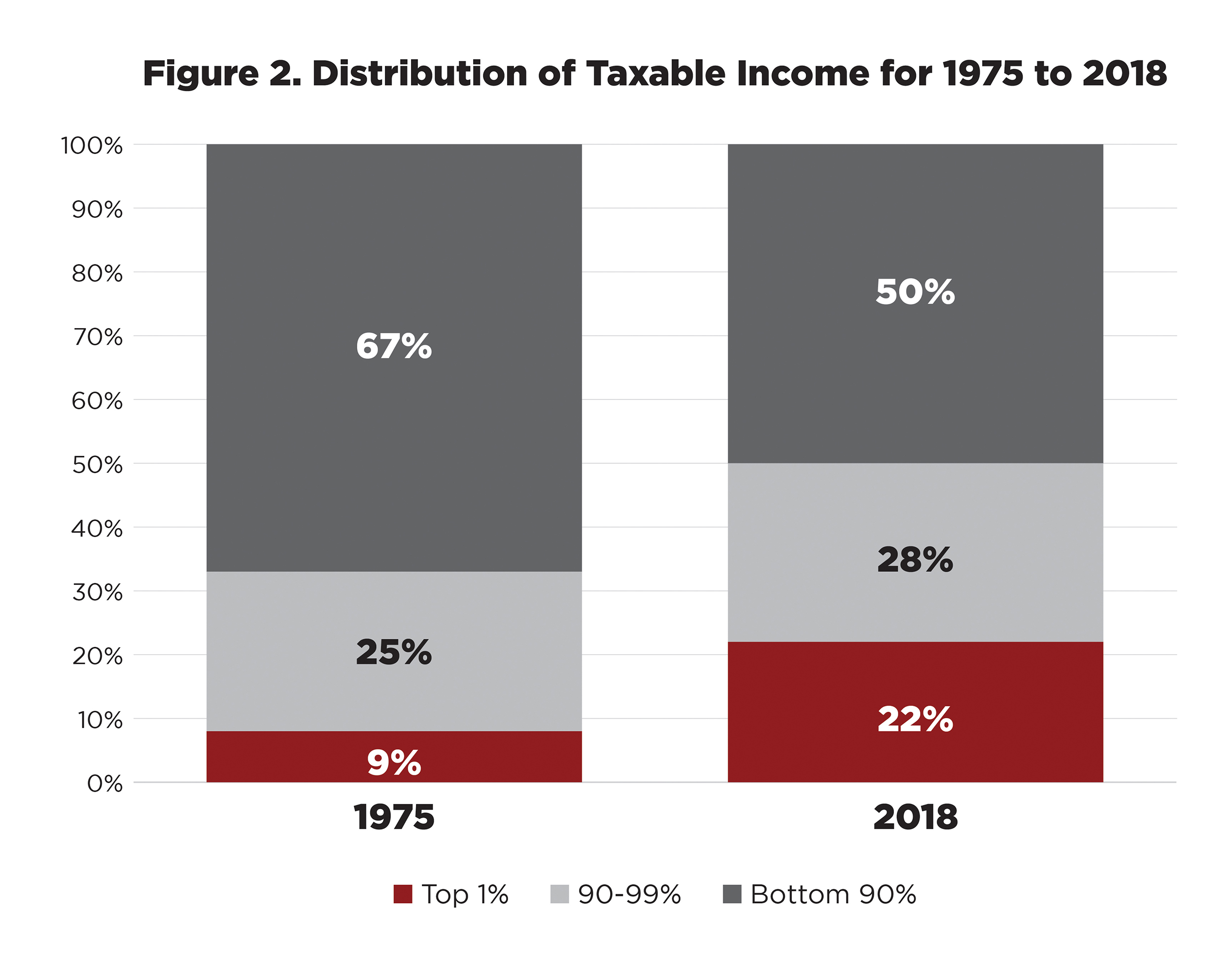

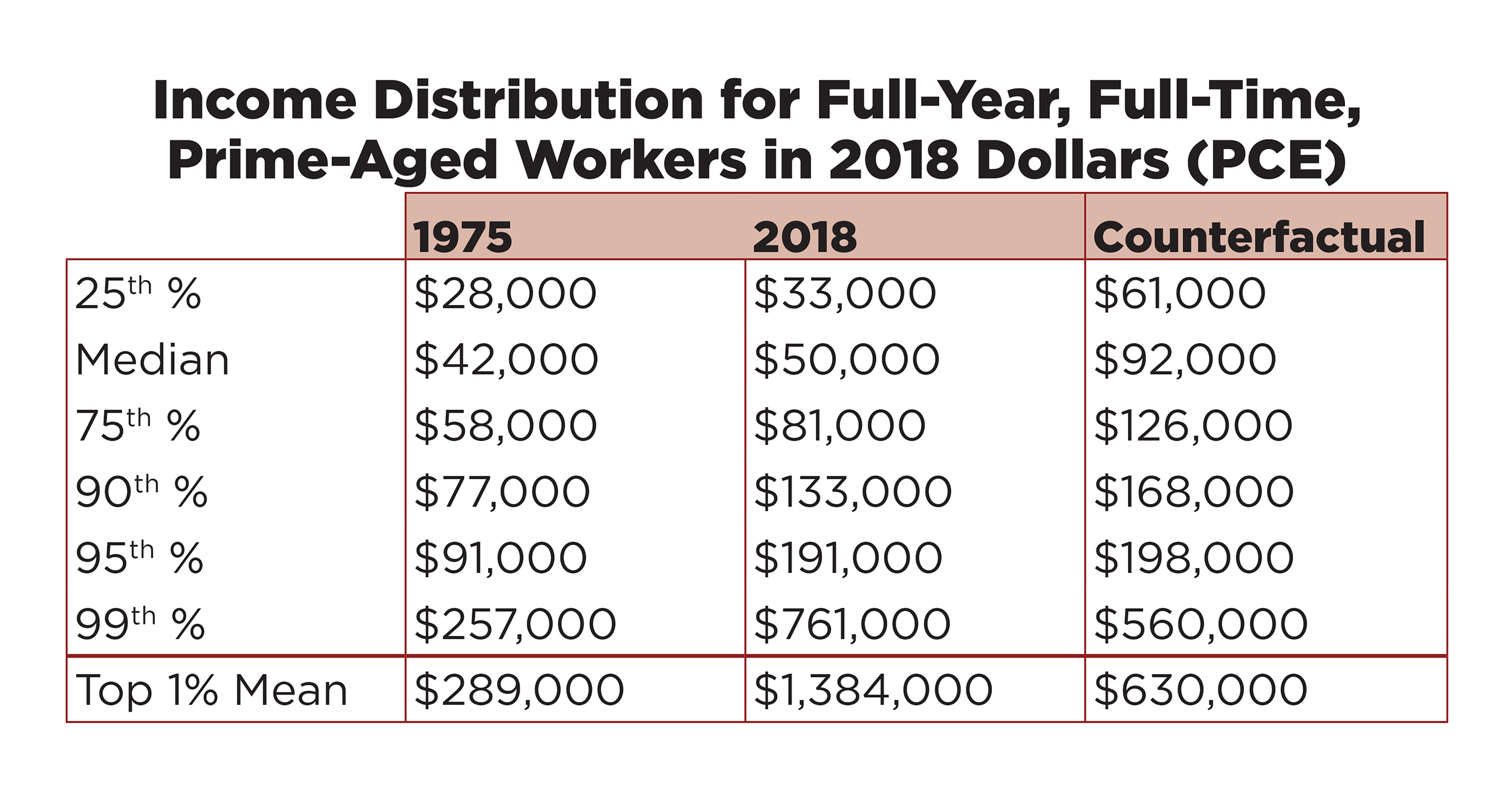

America S 1 Has Taken 50 Trillion From The Bottom 90 Time

Pdf Navigating Transfer Pricing Risk In The Oil And Gas Sector Essential Elements Of A Policy Framework For Trinidad And Tobago And Guyana

Tax Administration Reforms In The Caribbean In Imf Working Papers Volume 2017 Issue 088 2017

Malaysian Bonus Tax Calculations Mypf My

Malaysian Tax Issues For Expats Activpayroll

America S 1 Has Taken 50 Trillion From The Bottom 90 Time

Withholding Tax In Malaysia Definition Types Calculation 2020 Updated

Selling Via B2c E Commerce Channels To The U S Market A Guide On Shipping And Logistics

America S 1 Has Taken 50 Trillion From The Bottom 90 Time